| Target group | Maximum number of participants | Duration |

|

|

|

Bring employees the financial language they need!

The spoken language in business, is finance. Investments, sales, profit, cash are all essential elements of a business. And the strategic objectives of a company include these elements.

Focus on fundamentals

Participants run a business in a competitive team environment — setting prices, monitoring cash flow, making operational improvements, and planning for growth and profit. They also learn to use financial statements as a tool for measuring results. This 4-hour workshop enhances everyone’s ability to communicate, implement and exercise initiative.

Stealth Learning

This simulation develops business acumen through stealth learning – people are so busy having fun in the game that they do not realize how much they are learning. The business finance learning is thorough and participants gain a big picture understanding of business, finance terminology, working with financial statements, the importance of cash flow, and more. All while playing a game! They learn because they want to win.

Owning the results

Participants make all the decisions about production, marketing, sales, and finance… and own all the results. And they bond with team mates as they collaborate in a challenging game environment. Everyone receives materials that reinforce the learning in the business simulation.

LEARNING OUTCOMESThe spoken language in business, is finance. Investments, sales, profit, cash are all essential elements of a business. And the strategic objectives of a company include these elements.

Focus on fundamentals

Participants run a business in a competitive team environment — setting prices, monitoring cash flow, making operational improvements, and planning for growth and profit. They also learn to use financial statements as a tool for measuring results. This 4-hour workshop enhances everyone’s ability to communicate, implement and exercise initiative.

Stealth Learning

This simulation develops business acumen through stealth learning – people are so busy having fun in the game that they do not realize how much they are learning. The business finance learning is thorough and participants gain a big picture understanding of business, finance terminology, working with financial statements, the importance of cash flow, and more. All while playing a game! They learn because they want to win.

Owning the results

Participants make all the decisions about production, marketing, sales, and finance… and own all the results. And they bond with team mates as they collaborate in a challenging game environment. Everyone receives materials that reinforce the learning in the business simulation.

More about this simulation:

http://income-outcome.com/our-family-of-business-simulations/level-1-entrepreneurial-challenge/

About Andromeda Training Inc., the company that created this simulation:

http://www.income-outcome.com/about/

International companies that have used the Business Income / Outcome® Simulation

http://www.income-outcome.com/clients/

Accreditation is provided by Yissum Applied Management:

http://www.income-outcome.com/blog/bid/56385/Yissum-our-management-training-partner-in-Israel

In the Entrepreneurial Challenge® business simulation, the goal is for each participant – whether a front line worker, a manager, or an executive – to grasp essential financial concepts and tools such as:

- Income statements and balance sheets

- The difference between cash and profit

- Fixed versus variable costs

- Using operating income to compare results to competitors

- The need to control working capital

- Standard metrics (operating income, net income, ROA)

- Your company’s specific financial metrics

- Investing, generating profits, and posting losses

- Maintaining financial statements

- Implementing change and measuring results

HOW DO WE WORK?

During this activity, the participants become entrepreneurs or executive managers.

The teams in which they are active become companies operating in the same market.

The classroom itself becomes, meanwhile, an entire competitive market.

The teams in which they are active become companies operating in the same market.

The classroom itself becomes, meanwhile, an entire competitive market.

Our business simulation creates an ideal context for learning, in which lessons learned have immediate applications, being directly transferable to the reality of simulation, and then into daily reality.

The program uses a wide range of experiential learning tools: auditory, visual, kinesthetic.

They will improve their managerial skills as they "play" with the various decisions and contexts in which the simulation will put them, plan, and gradually work in more and more complex activities where all kinds of challenging situations arise. Just like in real life.

They will improve their managerial skills as they "play" with the various decisions and contexts in which the simulation will put them, plan, and gradually work in more and more complex activities where all kinds of challenging situations arise. Just like in real life.

OVERVIEW AND INTRODUCTION

Includes financial statements (how to read an income statement and balance sheet), finance terminology, discussion of cost structures, difference between cash and profit, and more.

TEAM COMPETITION

Team competition simulations consist of three business cycles in which teams have full decision-making power and are accountable for the business results.

In each cycle, the team-based companies develop and implement a business strategy which incorporates real-world dynamics: production capacity, customers, prices, and financing.

Each cycle includes competitor and market analysis; setting prices in a competitive market; monitoring cash flow; preparing an income statement and balance sheet; and posting, comparing, and discussing results.

Teams have opportunities to improve their companies with real world business solutions: expansion, quality initiatives, niche marketing, and more. Finance learning is wholly integrated within the simulation.

FOCUS ON YOUR COMPANY’S ACTUAL FINANCIAL POSITION

We turn to The Company Board, a 3D visual representation of your corporate financial position or industry analysis. This module connects the learning from the classroom to the real world. The tie-back and discussion relate the simulation experience to your company’s concerns, measures, and goals.

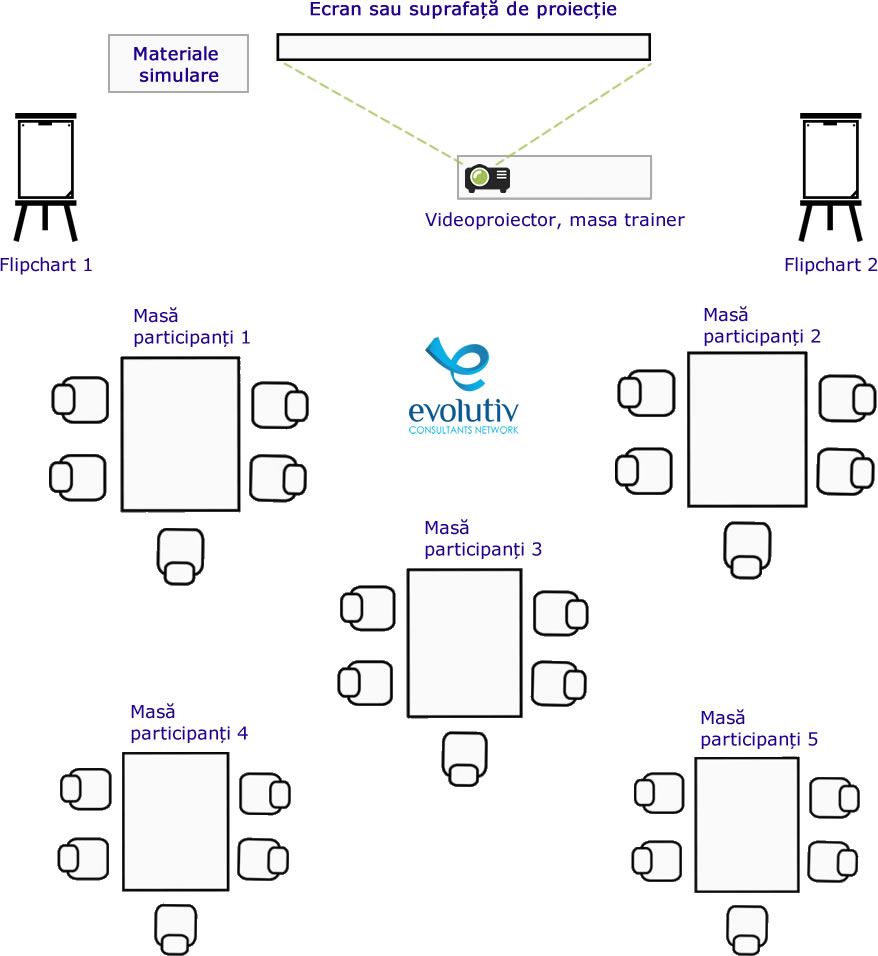

OPTIMUM classroom setup